E-FILING e-Postcard 990

MADE EASY

Information on e-Postcard 990

The Form 990-N (e-Postcard) is an annual IRS e-filing option for small non-profits, charities and exempt organizations that typically have gross receipts of $50,000 or less per year; This form serves as an electronic notice to the IRS.

An organization that fails to file any type of Form 990 for three consecutive years will lose their privilege of being an Exempt Organization. If the filing is not done on time, the IRS will send out a reminder notice through the mail.

Should I use ePostcard990.com to e-file Form 990-N?

ePostcard990.com is an online, cloud-based solution for exempt organizations that choose to e-file their annual tax returns with the IRS. Based on their gross receipts, tax-exempt organizations must submit a Form 990-N tax form each year that reports revenue, expenses, and activities to the IRS - and with epostcard990.com, transmit your return quickly and efficiently than paper filing.

Our service guides you step-by-step through the entire e-filing process. epostcard990.com is easy-to-use, and offers US-based customer support to assist with any questions or concerns.

Filing an IRS Form 990-N tax return doesn't requires a lot of tax information and time to finish. With our cloud-based technology, you can complete sections at a time and continue where you left off each time you access your account. Even if the IRS rejects your return, epostcard990.com will identify the reason, allow you to correct it, and re-transmit at

no extra charge!

Other Supported Forms

- FORM 990-N

- FORM 990-EZ

- FORM 990

- FORM 990-PF

- FORM 990-T

- FORM 8868

- CA FORM 199

- FORM 1120-POL

- FORM 8038-CP

How Do I File the e-Postcard 990?

E-file the e-Postcard 990 with the IRS through a trusted e-file provider by answering a few questions in an online form.

Step 1

Enter Your Organization's EIN & View Filing History

Begin the e-filing process for Form 990-N with e-Postcard 990 by simply entering the Employer Identification Number (EIN) that's assigned

to your organization by the IRS. If a 990-N form has been previously filed for your organization, you will see a summary of previous filings.

With this page, you can view your documented filing history to make sure everything's correct and on track for

your organization.

Step 2

Select Your Tax Year & Review Your Return

After confirming your filing history, you can select a new tax year for which to file a Form 990-N. With e-Postcard 990 you can e-file Form 990-N for the current and two previous tax years. So that means you can currently e-file for the 2024 tax year as well as the 2023 and 2022 tax years; unless your organization was terminated, you would then have to wait until a tax year ends to e-file. Once you've chosen your tax year, we will create your return based on your previously filed 990-N Forms.

Step 3

Pay & Transmit Form 990-N

to the IRS

After receiving your new Form 990-N with

e-Postcard 990, you will be able to transmit it securely to the IRS. Just pay a small one-time

transmittal fee to cover the processing for sending your form to the IRS and then you'll be ready to e-file. After submitting payment,

transmit your Form 990-N, e-Postcard 990 to e-file it directly with the IRS.

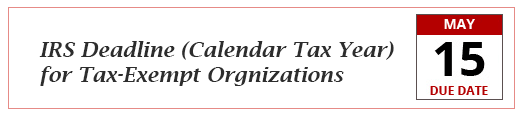

When Should I File the e-Postcard 990?

The filing deadline for nonprofit & tax exempt organizations falls on the 15th day of the 5th month after the end of the organization's fiscal period.

If the due date falls on a Saturday, Sunday, or any federal holiday, the due date is the next business day

Form 990-N (e-Postcard 990) FAQs

There is a large difference between the Form 990-N and the 990-EZ. Organizations use the Form 990-N if they have $50,000 or less in gross receipts. The Form 990-EZ is for organizations that have less than $200,000 in gross receipts and less than $500,000 in total assets. The 990-EZ is considerably more in-depth and also it includes 8 schedules which requires much more information than the Form 990-N.

If your organization has lost its tax exempt status, you need to re-apply for the tax exempt status reinstated. And you can use the existing EIN for re-applying the tax exempt status.

All tax exempt organizations are required to file an annual report to the IRS using one of the available 990 Form. The largest of these is IRS Form 990 , used by the large non profit organizations which is having more than $200,000 in gross receipts and over $500,000 in total assets.

For any organization which are not under the above requirements, the IRS Form 990-EZ may be filed if the organizations having gross receipts over $50,000, but under $200,000 and under $500,000 in total assets. For the organizations with gross receipts under $50,000, the Form 990-N (e-Postcard) may be filed.

Form 990-PF is for the annual return of private foundations or Section 4947(a)(1) non-exempt charitable trusts that are treated as private foundations. Form 990-T is for tax-exempt organizations to report their business income tax annual return.

No, you cannot file an amended return for e-Postcard 990. You can make corrections or update your information when you file your next e-Postcard in a subsequent year.

The parent and subordinate organizations of each group exemption ruling must agree on their filing responsibilities. If the parent organization chooses to file a group return for some or all of its subordinate organizations and those subordinate organizations agree to be included, then the subordinate organizations should not file their own separate returns.

However, if a subordinate organization is not included in a group return, then it must file its own return unless it meets another exception to the filing requirements. The required return that will be used depends on the type of organization and the amount of the organizations gross receipts.

There is no penalty for not filing Form 990-N (e-Postcard). If you fail to file Form 990-N you will get a remainder mail from IRS to file 990-N. If an organization fails to file any type of Form 990, then it is required to pay the penalty of $20 a day and which should not exceed the 5% of the organizations gross receipts and the penalty may vary depending upon the gross receipts of the organizations. If an organization fails to file for three consecutive year then the IRS will revoke its tax exempt status.